The Federal Board of Revenue (FBR) is preparing to introduce a series of taxation reforms through the Finance Bill 2025-26, with an emphasis on improving tax compliance among non-filers and digital service providers.

A major adjustment involves the daily ATM cash withdrawal limit for non-filers. The threshold will be raised from Rs. 50,000 to Rs. 75,000, but withdrawals above this amount will incur a 0.8% withholding tax. This increase was revealed during a briefing to the National Assembly Standing Committee on Finance.

Digital Retailers and E-Services Face Fresh Taxation

The government is tightening regulations on the booming e-commerce market, applying the following tax structure:

- 2% income tax on digital clothing sales

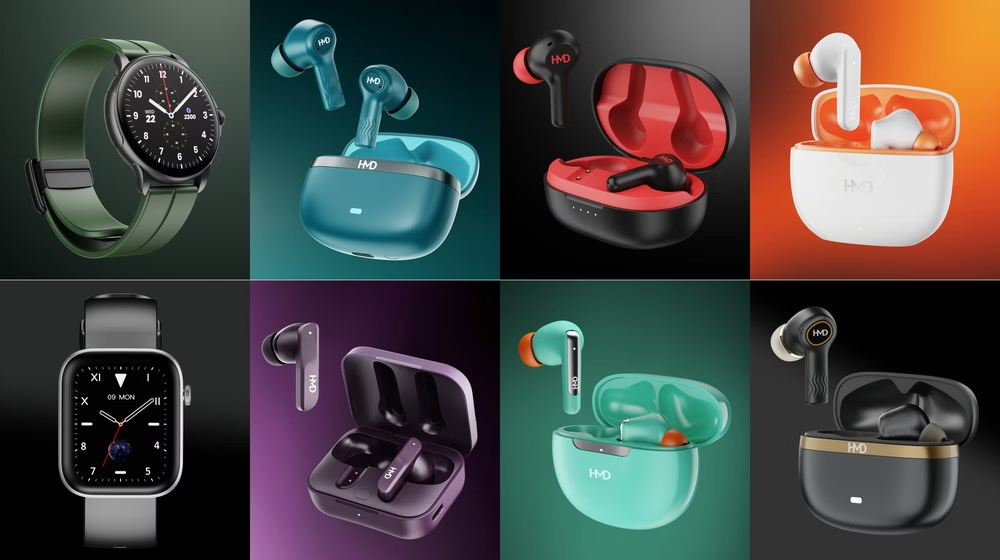

- 0.5% tax on electronic goods sold online

- 1% flat tax on all other e-commerce transactions

E-commerce platforms will also be required to provide detailed customer billing records, reinforcing tax enforcement mechanisms.

Foreign Digital Services Under the Microscope

In a move affecting multinational tech companies, the bill proposes a hike in the advance tax on digital services from 10% to 15%. The change targets income generated by platforms like Facebook, YouTube, and Google within Pakistan.

However, companies that establish on-ground operations in Pakistan will be taxed at a reduced rate of 5%, as an incentive for local investment and job creation.

The revised tax framework will also prohibit online sellers from adding tax-related surcharges to customer bills. Furthermore, banks and courier services are being enlisted to act as designated tax collection agents, ensuring efficient implementation of the new laws.

These measures aim to widen the tax base, regulate online revenues, and support a more transparent financial system.