Experts question CEO Jensen Huang’s claims that the firm foresaw the AI revolution decades ago

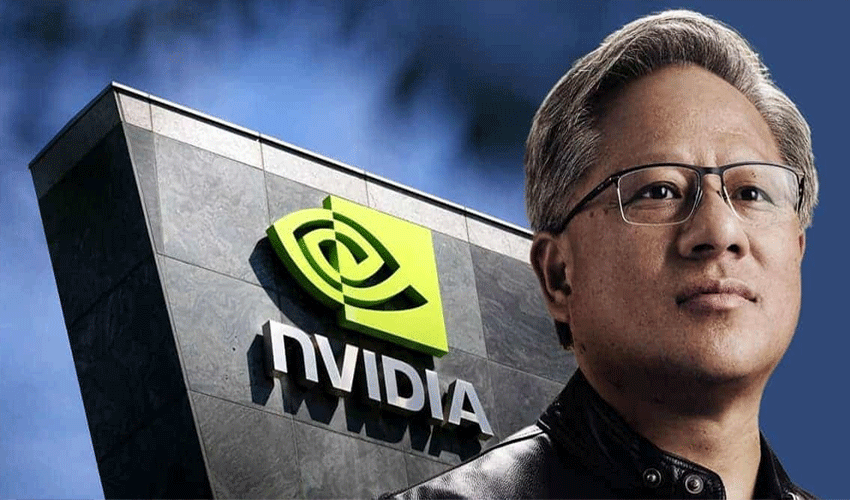

Nvidia has officially made history — becoming the world’s first $5 trillion company, with its market capitalization now standing at an astonishing $5.12 trillion.

But as CEO Jensen Huang celebrates what he calls a decades-long vision realized, industry experts and tech historians are asking a more provocative question: Was Nvidia’s dominance truly foresight—or a stroke of extraordinary luck?

The company’s meteoric ascent from a $3.3 trillion valuation to crossing the $5 trillion mark within months mirrors the global AI boom—and the world’s near-insatiable demand for GPUs that drive machine learning and generative AI models.

Yet as Nvidia becomes the beating heart of the AI economy, analysts are divided on whether this is the dawn of a lasting technological shift—or the inflation of a bubble waiting to burst.

Huang’s ‘Accelerated Computing’ Vision

At Nvidia’s recent GTC event, Huang described the company’s rise as a story of pure foresight.

“We made this observation a long time ago,” Huang said. “For 30 years, we’ve been advancing this form of computing.”

He credits Nvidia’s early recognition of the limits of traditional chip design—known as Dennard scaling—and its subsequent pivot toward accelerated computing as the foundation of its success.

According to Huang, Nvidia saw what others didn’t: the future of computation would be parallel, data-driven, and GPU-powered.

A Smoother Story Than Reality?

However, long-time industry observers suggest that Huang’s narrative is far cleaner than the reality.

For much of its history, Nvidia was a graphics company, focused on high-end GPUs for gaming and 3D visualization. In the early 2000s, the company experimented with various applications—video rendering, protein folding, physics simulation, and even mineral prospecting—most of which yielded little commercial success.

It wasn’t until 2012 that Nvidia began associating its GPUs with AI research, when academic breakthroughs in deep learning, particularly using its CUDA platform, began driving tangible results.

While Nvidia did build the GPU computing ecosystem, the argument that it foresaw the transformer model revolution, the rise of ChatGPT, or the global AI race is, as many analysts put it, “a neat revision of history.”

Right Product, Right Time

Still, luck favors the prepared.

By the time AI research exploded in 2016, Nvidia already had the hardware and developer tools—CUDA, TensorRT, and DGX systems—that scientists needed to train massive neural networks.

That combination of engineering innovation, ecosystem building, and, yes, timing, helped Nvidia dominate both the hardware and software sides of the AI revolution.

As one Silicon Valley analyst put it:

“Nvidia didn’t predict AI’s rise — it just built the perfect shovel before the gold rush.”

What Nvidia’s $5 Trillion Milestone Means

Nvidia’s story underscores a powerful lesson in technology: sustained success comes from a mix of foresight, flexibility, and fortune.

The company’s GPUs now power everything from OpenAI’s ChatGPT to autonomous vehicles, defense simulations, and scientific research.

But the question now is whether Nvidia can maintain this dominance. If AI growth cools or competition from AMD, Intel, and custom chipmakers intensifies, its valuation could face sharp corrections.

If, however, AI continues reshaping every major industry, Nvidia’s $5 trillion moment may represent not a peak—but the beginning of a new digital empire.