Chinese tech companies are accelerating efforts to expand into global markets as demand for smart glasses surges, fuelled by rapid advances in artificial intelligence and growing interest in wearable technology. Once a niche product with limited mainstream appeal, smart eyewear is now experiencing renewed momentum, with China emerging as one of the most competitive battlegrounds.

While Meta currently dominates the global market, a wave of Chinese firms is preparing to challenge that leadership. Established brands like Alibaba and Xiaomi, alongside start-ups such as Rokid and XREAL, view smart glasses as the next major computing platform. Their ambition is supported by a domestic environment uniquely suited to fast deployment and experimentation.

Chinese companies benefit from an integrated supply chain, a robust ecosystem of AI developers, and a deeply digitalised consumer base. Daily life in China, from retail payments to mobility services, is already driven by QR codes and mobile transactions. This infrastructure enables smart glasses to function as practical tools rather than experimental gadgets, with uses such as hands-free payments becoming viable everyday interactions.

Industry analysts say this domestic advantage is translating into rapid growth. Smart glasses sales in China are forecast to have risen by more than 100 percent year-on-year in 2025. Xiaomi’s debut in the category has been cited as a breakthrough moment, ranking among the top-selling models even with a limited launch period. Smaller firms like Rokid are also attracting global attention, successfully raising more than four million dollars through crowdfunding.

A key selling point for Chinese manufacturers is flexibility. Rokid, for instance, allows access to a range of popular Chinese and international apps depending on where the device is used. The company also supports multiple AI systems including OpenAI, Gemini and Llama, rather than locking users into a proprietary ecosystem.

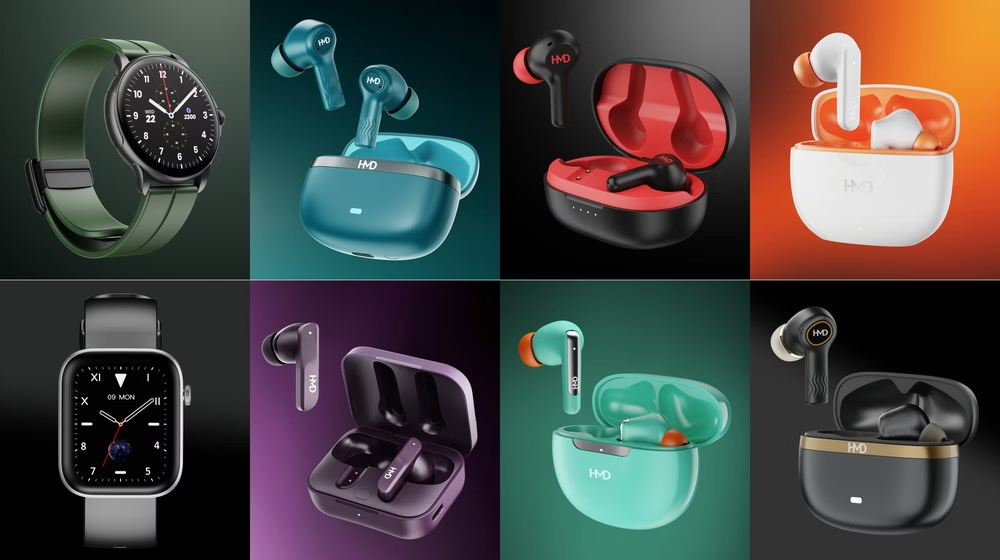

Chinese brands are investing in design and hardware as they prepare for global expansion. Partnerships with eyewear manufacturers such as Bolon aim to make devices fashionable and lightweight, addressing a primary concern among consumers. Analysts note that appearance is now central to user adoption, pushing companies to rethink smart glasses as everyday accessories rather than futuristic gadgets.

Despite strong progress, challenges remain. Meta held a 73 percent global market share in the first half of 2025, driven largely by the Ray-Ban Meta Smart Glasses, a product widely praised for blending functionality with familiar aesthetics. Experts say Chinese companies also lag behind in advanced components such as optical waveguides, as well as chip technologies that enable more powerful and energy-efficient devices.

Privacy concerns represent another obstacle. The possibility of wearable devices discreetly recording in public spaces has prompted regulatory scrutiny in multiple markets. Analysts argue that widespread adoption will depend on transparent policies and user-friendly controls that balance innovation with consumer safety.

Manufacturers remain optimistic that the current generation of smart glasses will pave the way for a long-term shift in personal technology. Executives in the sector suggest that glasses, not smartphones, may eventually become the primary interface for digital services, signalling a dramatic change in how users interact with connected devices.