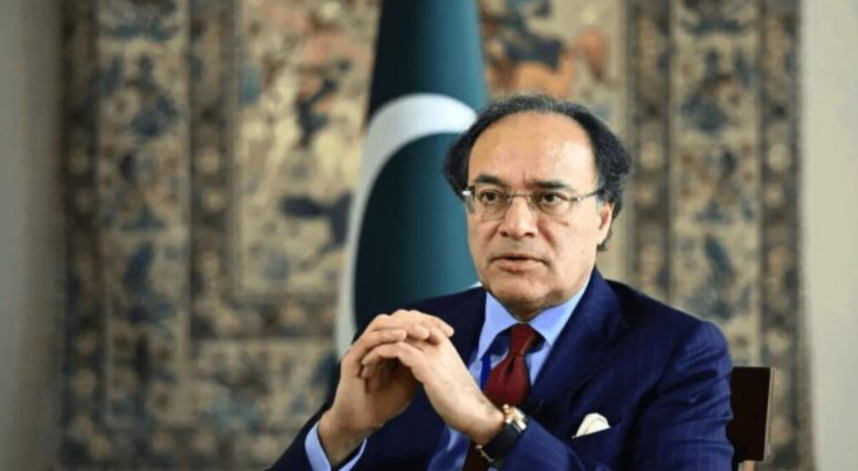

Pakistan has called for climate resilience to be embedded into global financial frameworks, with Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb stressing that traditional systems must evolve to meet the realities of climate change. Speaking at the Global Development Finance Conference, Momentum 2025, in Riyadh, the minister emphasized that vulnerable economies no longer have the luxury of treating climate adaptation as a secondary priority.

Aurangzeb participated in a high-level panel alongside senior representatives from Jordan, Tajikistan and the West African Development Bank. The discussion centered on how climate-exposed countries can secure the capital needed to manage rising environmental risks, support recovery efforts and invest in long-term adaptation.

Drawing from Pakistan’s own recent challenges, the minister highlighted that climate change is no longer an abstract concern. He referenced the catastrophic 2022 floods, which resulted in an estimated US$30 billion in losses, followed by new flooding this year expected to shave almost half a percentage point off Pakistan’s GDP growth. He noted that the country has had to build fiscal buffers to fund emergency responses using domestic resources alone.

However, reconstruction and large-scale adaptation, he said, require access to significant external financing. Pakistan’s progress in preparedness includes the development of an AI-enabled early warning system at the National Emergency Center, which now issues monthly climate forecasts. Still, Aurangzeb emphasized that Pakistan’s internal capacity remains insufficient given the scale of climate vulnerabilities it faces.

The minister pointed to the 10-year Country Partnership Framework with the World Bank Group, which allocates around US$20 billion, with one-third earmarked for climate resilience and decarbonisation. The challenge now, he said, is ensuring that Pakistan develops strong, bankable projects that can unlock these funds efficiently.

He also expressed concern over the slow and bureaucratic nature of major global climate financing channels, such as the Green Climate Fund and the Loss and Damage Fund. In contrast, Pakistan has begun securing support from multilateral partners, including receiving the first US$200 million tranche under the IMF Climate Resilience Fund.

Responding to questions on aligning climate and development goals, Aurangzeb said national budgets worldwide must mainstream climate priorities to attract external financing and crowd in private investment. He also noted Pakistan’s strengthened engagement with the United States in minerals, digital technologies, and renewable-aligned sectors. Highlighting the Reko Diq copper project, he described its US$7 billion financial close—backed by IFC and the U.S. EXIM Bank—as transformational, with potential export earnings projected to reach 10 percent of Pakistan’s current export base by 2028.

Aurangzeb reaffirmed Pakistan’s “and-and” approach to global partnerships, balancing long-standing cooperation with China under CPEC’s new Phase 2.0 while expanding ties with the United States. This balanced strategy, he said, positions Pakistan to attract diversified investment that supports both development and climate objectives.

The session concluded with consensus among panelists that collaborative financing, innovation and regional cooperation are essential for helping vulnerable countries withstand accelerating climate pressures and pursue sustainable growth.